The profit

Introduction

The excess

The key of profit

The union investment strategy

Know reinvest

Combination: profit and fair

The obliged profit

Remedy for the lack of profitability

Unite to rein better

The art of well calculating

The maintenance of an organization

It makes you wonder if our economic and organizational functioning if it is really suited to our current needs. Obviously, we do not find enough alerts to justify the questioning of our operation as a society, but currently many threats on our shoulders and make it sound the bell that pushes us to be on our guard.

The first example I can give you is the government debt which rise every day, and this widespread on our planet. If governments can no longer provide the services origins, this is a serious economic decline which will require working occasionally on the subject to find the best solution. Moreover, when government revenues decrease it also means that companies are less profit before they pay less taxes. Profit was also generated by an abundance of resources that crumble more. It would be interesting to review how we can generate enough of both economic and social profits (not to become machines work).

Another study dimension of the profit would be interesting on how nature happens by itself to generate profits as both energy and at the level of physical elements. So look at different angles study of profit.

|

Back to the top of the page |

The keyword that best represents the profit is according to the author "excess." The excess in our society has generated the overall benefit of society. As the technology that has helped contribute greatly to produce excess quantities and quality, as the abundance of resources has also helped generate a surplus. Only here we must consider the excess from another angle. The excess requires great management able to contribute to produce profit.

The excess in the 1920s contributed to the economic growth, but also contributed to its downfall in 1929. Obviously, the excess is required to produce economic growth, but here this excess must obviously be distributed in exchange for financial asset to be considered beneficial for the industry and businesses. Economists say that it all depends on the demand, but to what extent is this true. Demand would be stronger if the means of people were stronger.

What is assumed that all depends not only demand, but also the quality of a good management of economic resources as a fair redistribution example. In addition, the demand depends greatly on what employers or people means will give back to the population to power the economic cycle. The economy view as a cycle is more realistic. If an element is blocking at the level of investment, then the demand crashes too.

Because the cycle of the economy must always be powered by moneylenders, the total range of the economy may be far too large for these lenders and the economy could not function as before. This is because one day the maximum will be achieved in the industry regarding the great technological progress that drives the economy, in addition to the depletion of resources worsens, it is therefore necessary to rethink new bases in today's economy while it is change have not yet occurred.

There optimist who believes that everything works out alone without intervention, but it is a little believe that rain will fall afloat in a desert. Obviously, nothing is done alone. This time, with the massive indebtedness of the population which enabled drive the economy to date risk not be as effective. Governments, as well as municipalities face a debt that continues to grow and no one can change anything. The same fate is already happening with the industry, as we have seen in the automotive industry recently. The excess has decreased, without excess, economy will no longer be in the same situation today, although now our economy is in part already endangered by over-indebtedness.

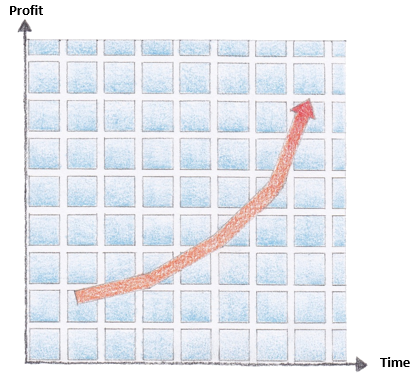

Figure 1 shows the ideal situation of an economic entity which receives a profit over multiple periods in time. In the ideal situation, the profit is increasing in each period. But more realistically, profit fluctuates, so the profit curves can also be down in part.

In reality, all economic entities hoping to receive profit as the ideal situation shown in Figure 1, but to get there will require entities can use their profit, that is to say that economic entities must reallocate profit in the economy. Growth is subject to a lot of factors that often economic entities do not control.

|

Back to the top of the page |

The key of profit lies in the organization of how we make a distribution of our resources. We must avoid creating concentrations. For example, playing casino, to play longer, for the pleasure lasts longer with the same money, we must avoid to any concentrate putting on a game played. Obviously, when we look also how we organize our expenses, we can make a larger profit on sustainable elements.

Invest in sustainable things avoids having to concentrate identical redemptions. But of course, it all depends on your budget too. You must allocate your investments (or expenses) so as not to create concentration. For example, if you have to do grocery shopping, you will not buy your purchases focusing on a single food category. Well, the key profit lies in the distribution of resources. Seen from this angle, it looks easy, but in reality it is much more complex than that.

True understanding of the key of profit is determined by investing so as to push the limits. So to invest push your limits, that is what creates your profit. We must not concentrate, but lie! When we lie down to push the boundaries, this is how we help to create an excess, so a profit.

This brings us to develop another key part of the profit based on the variable exhaustion. For a profit can last all depends on if we have exhausted this source of profit. How is the exhaustion reaches less quickly? This will depend on the ration that is carried. Even if a resource is abundant, the best way to profit is not to strive to tap this resource with abundance, because often we waste more easily. Rationing is a science that can be learned. Rationing is not only divided or shared over a period of time.

Science rationing occurs by recycling resource. For example, from the perspective of financial resources, recycling does not mean take the money we paid, it means reinvesting investment to other goals. Here is a science, since not everything can be easily reinvested. For which to create a profit, we must give a longer service life investment. It is an economic art of composing its investments so as not to render obsolete something which still produces quality.

|

Back to the top of the page |

When we use the word strategy, it refers to a series of actions in a logical order to achieve objectives or goals. But however, we specify that the union following the word strategy and ensures that the symbolism of the word strategy changes from the general definition. With the union, strategic word refers to apply consistent assembly methods investments.

Consistency is here implemented to denounce the investment diversification does not always lead to any strategy that is coherent naturally. The strategy here is to make profitable investments in progress and not begin to spread risk by diversifying investments. Although at present such non-strategic diversifications exist among many investors, but it does not achieve optimum for investment requires greater development.

It also goes without saying that creativity plays an important role in the union of investment, such as to build efficient and competitive companies, that creativity is needed to expand the business concept.

The union strategy that will be presented will expand the creativity for reinforcement in your investments. First, the union strategy is a form of gathering that theoretically proven in the study of science by which the union is a key that amplifies the perception that we have on the operation of a system. Whether you're in a system as another, we must understand that you are located in the subsystem of a larger system. And indeed, your investment is a subsystem somehow. Now you need to contextualize your investment compared to other larger systems that exceed your investment.

The union strategy is to spread the kind of decision to establish your investments according to your subsystem or between other larger systems. These are decisions that are not easy. First, let the market decide where you are is realistic to the extent that you can not isolate yourself completely from reality, and perhaps you are able to influence the market, but it remains nevertheless the reality is always present in your subsystem (or business). Reality should influence you on the opening of the market in which you face, so even if you are part of a larger system, you need to incorporate this system in your subsystem, and it's called strategy union.

The union strategy is to incorporate the larger system within your subsystem is somehow the key. To get to incorporate something smaller, you have to make some concessions, that is to say, the sacrifices of the personality of your investments. This is done so by standardizing your investments. As the market is a larger system, it is more profitable to take advantage of the nature of the market. This nature of market is called as the available training, education of employees, product formats, generic manufacturing methods and production standards, and other standards that establish a functional union strategy in your investments.

It is easy to develop non-compliant or say "adapted" solutions, but as it is also easy to get lost in developing solutions as uncertain. To achieve a better profit from your investments, you should also take advantage of the solutions offered by the standard solutions which are usually less expensive since they are already designed to be competitive solutions.

Integrating standards in your investments will give you certain advantages. Rather than to prefer uncertain solutions, opt to things that have already been well studied. Be as creative, but stay vigilant and keep a hand this creativity in your research and development into new standards that enhance the market that your investments are being used. The integration of standards is a way to give greater value to your investment by making them more profitable.

|

Back to the top of the page |

Although somehow accounting of businesses calculate depreciation on equipment, this way we calculate how much we need to reinvest in the business for the company remains at the same value. But there is a widespread fault that is produced via this method of accounting.

First, the fault is calculated that need to reinvest an amount equal to the same material, which is wrong, because there is also inflation that is not calculated and therefore inflation raises the value that we must reinvest to purchase new equipment and services consumed (machine, salary, commission, maintenance building, etc.).

A company needs more capitals to operate. So these capitals that the company needs eat away the profit margin paid to business owners. It is not always possible for the company to increase its sales revenue because competition. Is that the company in a highly competitive field must sometimes descend to its profit to reinvest enough. There is a danger that the company in a competitive field wants to borrow in order to reinvest to function as it should work and pay the same margin of profit to its owners.

The other thing that disturbs the profit margin, is that the company must improve to remain competitive in their market. Which again request to reinvest in infrastructure extra money to be able to improve what is already in place. And again, there is the caveat that the company has to borrow to pay for improvements (including research and development) in order to remain on the market and still pay the same margin of profit to its owners.

Finally, inflation, the fact that the company must increase its competitive price, if it can, is also generally erode profit on the portion paid to its owners because they usually have to pay more expensive because of the inflation widespread.

But there is a remedy for this. Contrary to the idea of profit maximization, we must opt for optimization of profit. Instead of always wanting to get the maximum benefit to our company, just sacrifice a part in the development and cost increases for the company. This prevents for the company to venture into a debt structure. In addition, reinvestment calculated in this way should contain in the "estimated cost" rather than "owner's equity", since in reality it is not a direct reinvestment, it is to take into account the costs for the company in the future.

So, back to the idea of optimizing profit by reducing the portion paid to business owners in order to avoid fluctuating at one time or another the financial structure of the company into debt. Hence the idea now know reinvest that it is also to optimize profit, not maximize it.

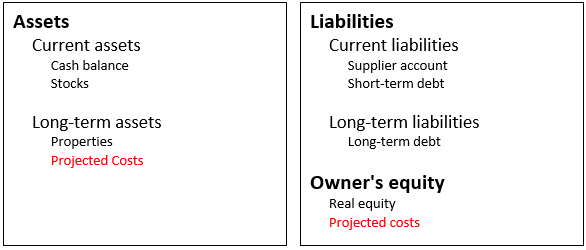

Corporate balance sheets should have the "Projected Costs" account in the balance sheet as shown in Figure 2. In this account, companies must put funds in anticipation of higher future costs.

"Projected Costs" account

It is advantageous to have a "Projected Costs" account since, in effect, this prevents the company to report increases in cumulative costs on large investments. This also allows the company to have the cash on hand to cope with the increase in futures costs, as assumed buy expensive machinery to periodically replace or repurchase or renovation of an existing building. In Figure 2, the "Projected Costs" account is also put in the "Equity Owner" balance sheet (balance sheet must balance "Assets = Liabilities + Equity"), but it is not a real equity, it is actually a loss since inflation make increase the projected cost is not a gain, it is a loss. As well as research and development to make the company more competitive, it is also costs to expect that should go in the "Projected Costs" section of the balance sheet as these costs are expenditures to update the company, and therefore it is as one might say an expense rather than an investment in a certain way.

The optimal profit, rather than the maximum profit, makes the balance of a business more realistic. In addition, it lessens the effect of surprise of some reinvestments that require more funds. Know reinvest in this context means that there must be additional investment in an organization, be aware that this will affect the business, where prevention is definitely useful in this context. Therefore, business owners should never opt for a maximum profit, but optimum profit.

|

Back to the top of the page |

We consider profit as a benefit. In the general definition, we can understand that the excess (profit) transaction must be regarded as a benefit, but not scientifically, it is not a benefit.

This is explained in this way, if you get a profit, it is because you gave something equity pledge. So you got a profit, but the profit was generated in the exchange of other values that you already had before the exchange. So you got a profit equity pledge exchange against another value.

The exchange is therefore not primarily responsible for the creation of profit. The responsible is the creation of value. In creating value, you create your profit. This is not the same as saying that you get a third of the profit. Because the profit was generated from the value you have created. Even the term "enjoy life" would have greater meaning by associating it with the value that people create and not exchange against a good or service. The profit is created by the value generated by a person or organization. We therefore take us lingering values created and not the exchange.

Another striking point is how can we assess the value correctly? This task is usually done with the features compared with other features. The value cannot always be assessed in terms of trade, as we should not be evaluated in terms of an exchange. Values can be varied and sometimes these values are easily included in the exchange, otherwise how shall we say it's worth more than the price of the exchange? As it is the case of a medical intervention or a drug that saves a life, the value cannot be accounted for by the price of the exchange. But more specifically, the value must also and should be surplus to prices because the profit for the consumer is the value that exceeds the exchange price of a good or service.

In this last section, we make a reference to a major dilemma faced by our society between the value at the price and the actual profit. Profit should be generated for both the creator of values and both for those who will use this value. Where should rightly condemn what is a short-term opportunity and opt for a value that will last, because sustainability of a value is the benefit of the consumer. The profit of the producer of goods and services is a value equity pledge, and not the result of a differentiation between the cost and selling price. Even if we consider the cost, profit is the excess cost value should be shared among stakeholders in the exchange.

In Figure 3, we represent what should be the part of the value compared to price that is lower and so the cost of production is less than the price.

|

Back to the top of the page |

As we were talking about value that represents the profit, there is here a form of understanding that helps us understand the meaning of the concept of value over the asking price. First, the understanding in a closed context is blurred as the example of Figure 3 in a closed context. But studying the value chain, that is to say from the beginning to the end. In reality, there is no end here as economic exchange are performed from a company to another, and so on. But the concept of the value chain is that the value generated by a company to another must always be greater than the asking price for the company that receives the property can in turn create profit.

In this context of profit obliged by the value chain, we understand that profit must be completely absorbed from one entity to the other so that each entity can exist on the market. In fact, profit is therefore obliged by the issuing entity of value to his client must also use this value to stay in business. And in the case of an individual, he must also make a profit to maintain a decent standard of living.

Obviously, the competition created by the competitor causes the obligation of an entity to offer their goods and services at a price that will not reach their true value.

|

Back to the top of the page |

A company with insufficient profitability does not mean that it is bankrupt. Profitability may be insufficient to investors for different reasons. Insufficient profitability means that the company does not generate enough profit to meet the expectation of investors (shareholders or owners). Sometimes companies may be in a period of decline and this part may result in lost business opportunities, lost sales, any losses in relation to an antecedent level. This means a lower profit level compared to the level expected. But there are several solutions to this, one that we will address.

In the business world, in a situation of insufficient profitability, business managers may consider restricting their activity, relocated production centers and service, replace labor by sophisticated equipment, do promotions on sales, etc. All means can be considered effective from a certain point of view for the accountancy of the company, but it sometimes causes breaks with employees, with business partners, etc.

Means that must be addressed to solve problems of insufficient profitability is tolerance. Often, managers want to be very sensitive to the slightest variations, but they forget that sometimes it's normal that the company is in a less profitable period. The economy is like the temperature, one day it is very hot, the next day it is cooler. Often, managers and investors have in mind a target rate of return they want to achieve perpetually. But do not forget that if all firms affected by lack of profitability acted with the consequences, to join an economic target, is like trying to eat the carrot at the end of a fishing rod. But in reality, the target is not a cost, it is your business you attack quickly varying its functional structure.

Already produce and have some profitability is a feat. We must not sink to want overfished its employees, for example, want to achieve greater profitability, because in the end the lack of tolerance is transformed company with a structure too sensitive to changes market. The lack of tolerance leads to abuse in some way, even if the regulation allows somehow is still stretched regulations.

Tolerance is a kind of force that must be developed to achieve building a resistant empire to changes in economic markets. The lack of tolerance leads to decision making that does not help the economy most of the time. The economy is like a big company which we must work on to embellish. Even individuals should also tolerated sometimes their pay is not always the expected level, since the lack of tolerance is a way to destroy economic growth, because in reality, economic growth is just starting to level and go beyond. Thus, economic growth is not to lower relative economic potential. Hence we need more tolerance in the economy to achieve truly better, without subtracting growth factors.

In addition, we can blame the waste of economic resources made in good times, and even during hard times, waste does not actually decreases. You would need less tolerance if the decisions of each investor and manager were directed not to leave on the back of someone else's economic growth and just plan a modest profitability. Be more tolerant is also required in the choice of investment from the outset. Wanting only opportunities most profitable business is to operate investments temporal profitability rather than long term, as investors want more profit, then their economy becomes temporal. But one day, individual behavior in poor design with the economy may seem more.

|

Back to the top of the page |

Economically, a union of players in a market can make a difference in the profitability of a company in this market. This does not mean to create a cartel, no the difference is that a union is a union with the customer and the producer. The union begins with the client must support a brand or company. Already, this form of union exists, but it is transparent. There is not enough control so that the customer agrees to be faithful without the fear of being wrong. And on the other side, the customer chooses options that do not provide positive impacts on the economy. How to join the client and producer at the same time?

Many experiments were conducted by firms in marketing to achieve customer loyalty, but again, there are no miracles that were found. The union must establish something for this to succeed. Indeed, the union will actually help control something like a real union business. The client must have the control to the union happen. There are different method that helps to create a union such as listening to the consumer, survey, but it is not a true control, it is direct or indirect approach to obtain the views of the client and not more it.

For the union to take place, companies will let customers make decisions. This is not an easy to do approach because it is a new topic that could let the customer decide. With decisions, the client is motivated to become more adept at what he himself had designed. For example, a purchase of a product or service should give points for voting on taking any decision in the undertaking producing the good or service. And nowadays, with the means of telecommunication and IT that are available, it is very simple to implement a form of joint website (or custom) for this kind of client decision making.

|

Back to the top of the page |

The profit is excess obtained after an investment becomes profitable. Before investments are made, there are forecasts that are performed to determine the profitability of such investments. These projections are calculated, so we have to make these predictions to correctly calculate its risk.

Everything depends on what methods you use to make your forecast, you build scenarios, the most optimistic less optimistic. This is where managers are wrong, they calculated that their investment is expected to generate sales level hope, but they retain their original investment plan is to maintain the same level of investment despite the scenarios. There is a whole stupidity. Managers should rather review their investment plan based on the least optimistic scenario. They must adapt their investment plan for always predict profitability, and we will discuss other methods that can be considered for safe investment.

To calculate realistic forecasts, as the ambition must be accounted for. The ambition of the project is what will motivate you to take a certain level of risk. And to calculate your ambition, you need to know which variables you are taken to your importance. This is often too much importance to things that causes misperceptions about the potential impact of these elements on your project. An ambition too large can lead to greater disappointment. Have the best possible a more moderate ambition that allows you to make more realistic forecasts.

The other factor that must be taken into account to make good forecast is to build your project into several pieces, that is to say, build your plan forecasts a gradual instead of putting everything in a single analysis. Obviously, there are there efforts that managers and investors should take as conquer market share more slowly. So invest progressively is a much more certain way. At least you will not sacrifice your entire investment capital. And of course, this applies when it is possible to make your project with the progressive path. Usually, with a moderate ambition, it is possible to build your project in pieces.

|

Back to the top of the page |

An organization is not as such a machine to generate funds for investors. When preparing to invest in an organization, we expect to maintain this organization for various social and economic reasons in order to create something. Maintenance of an organization must be a priority before the profit that can be drawn. Organizations are built primarily to meet a social need, therefore satisfy customers about it.

A profit is a business opportunity that fits well with the organization. This profit is first expected by investors in order to meet their interests after satisfying the interests of customers. The importance of maintaining an organization is an economic entity has a need to make many sacrifices, as the investment of the owners, and a portion of the investments of many stakeholders such as employees. A company is also the symbol of success in business of many managers and is also the reputation of borrowers / investors.

Nowadays, it is not uncommon to see that investors are abandoning business retention for lack of involvement in their organizations. The maintenance is not only to make a successful organization, but also to enrich the economic assets of the company. Maintaining it is the beautification of an organization, make it even more beautiful and better. Often when limits have been reached, no more trying to push those limits. Maintenance is fueling the evolution of an organization. Maintenance must be sought even if we must sacrifice even more. Maintaining it is a chance to give even an organization to do better. It is easy to see that many investors ring the doorbell next door by leaving organizations judged disorders. But the maintenance could avoid having to start over. Maintenance is to enrich themselves by enriching what one holds to adapt to new situations.

|

Back to the top of the page |